I've been paper trading a seamingly simple SuperTrend (22, 3) breakout strategy with a long-term moving average (EMA 200) for confirmation for the past two to three weeks.

Trend Following and Breakouts

What I learned from reading is that the "secret sauce" of trend following is:

-

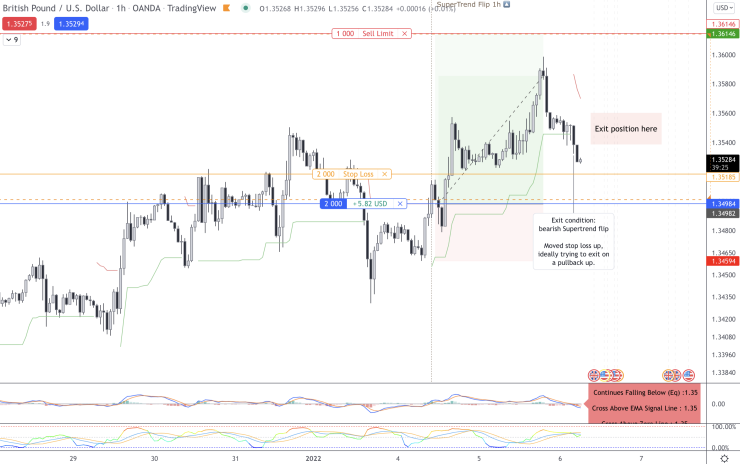

Keeping the losses small: This can be achieved by trailing stops as price moves favorably, which means that even if the stop is not yet in positive territory, just moving it up means the loss it would have will keep the loss smaller, as it would have been, had the stop not been moved. Trailing the stop could mean waiting until a 1.2-1.5R take profit has been reached, and then moving it as well. Trailing the stop in the loss area is a technique I learned from studying Adam Grimes' trades.

-

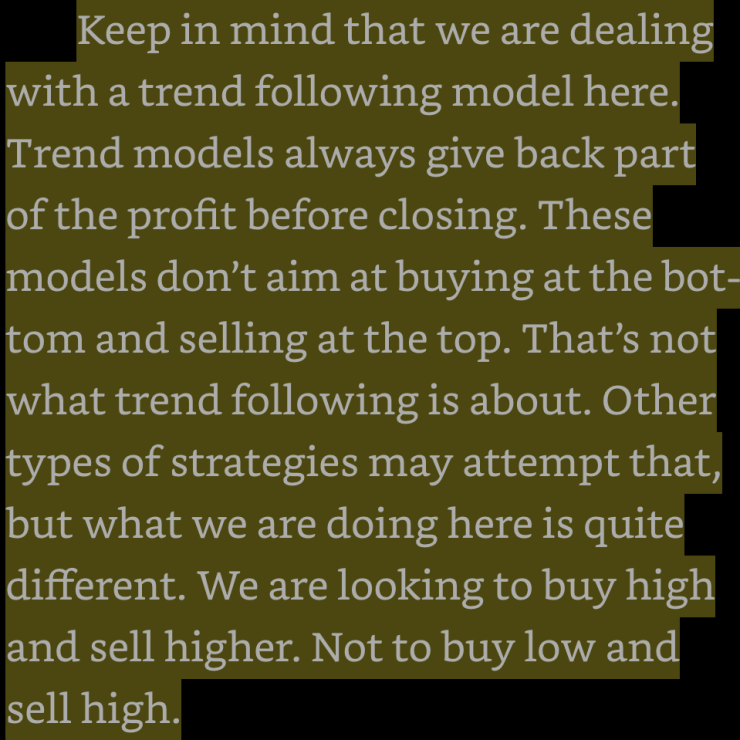

Trend following strategies always give back some of their profits, when the market turns against the position. (Andreas Clenow: Trading Evolved)

-

-

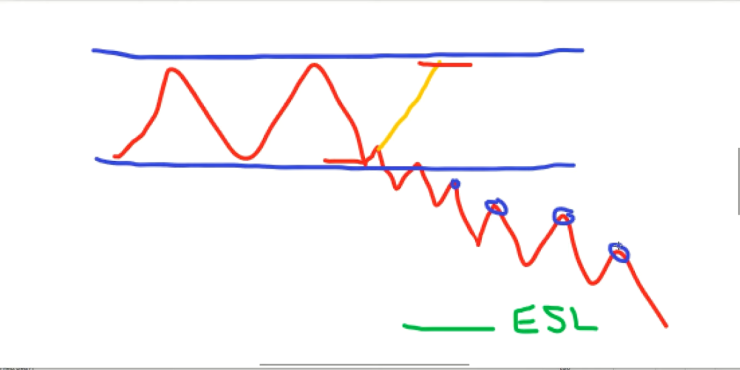

Another good idea comes from Darwinex: When market moves against a position, and the exit condition would meet, then move the trailing stop to a more aggressive position, but actually attempt to exit on a pullback.

- What also helps with this strategy is trying not to get over leveraged. This can be achieved with a simple rule like "no more than two new entries per day or week. In crypto especially this negates large correlation effects. Another twist that can be added to this rule: new entries are allowed again once one of the take profits on open positions hit, and their stop losses have been moved to break even.

Here's a live example that I'm currently trading:

Just doing these things didn't make life-changing money, but seems to keep the account growing steadily. I trade this on the hourly charts with crypto and forex markets mixed. Forex markets more sluggishly though, because, I believe, most a more mean reverting. When forex trends, however, they really do seem to trend well.

Current Examples of Supertrend Flip With Long-Term Trend

Here are two example that I was able to capture, after the market pulled back.

Final Words

I would like to encourage you to do some thought experiments on your own. For example:

- What happens when the entry is not on the signal, but delayed after a small pullback?

- Can we improve the strategy by "scaling into" a trade, e.g. add multiple buy orders? Downside, obviouusly, if the original trend continues strongly, the remaining orders won't fill. But on the upside, we would get a better fill price, when the trend continues after the pullback.

- Third, can you improve your strategy by living a tip in my Bitcoin wallet? Only one way to find out. ;-)